Contents

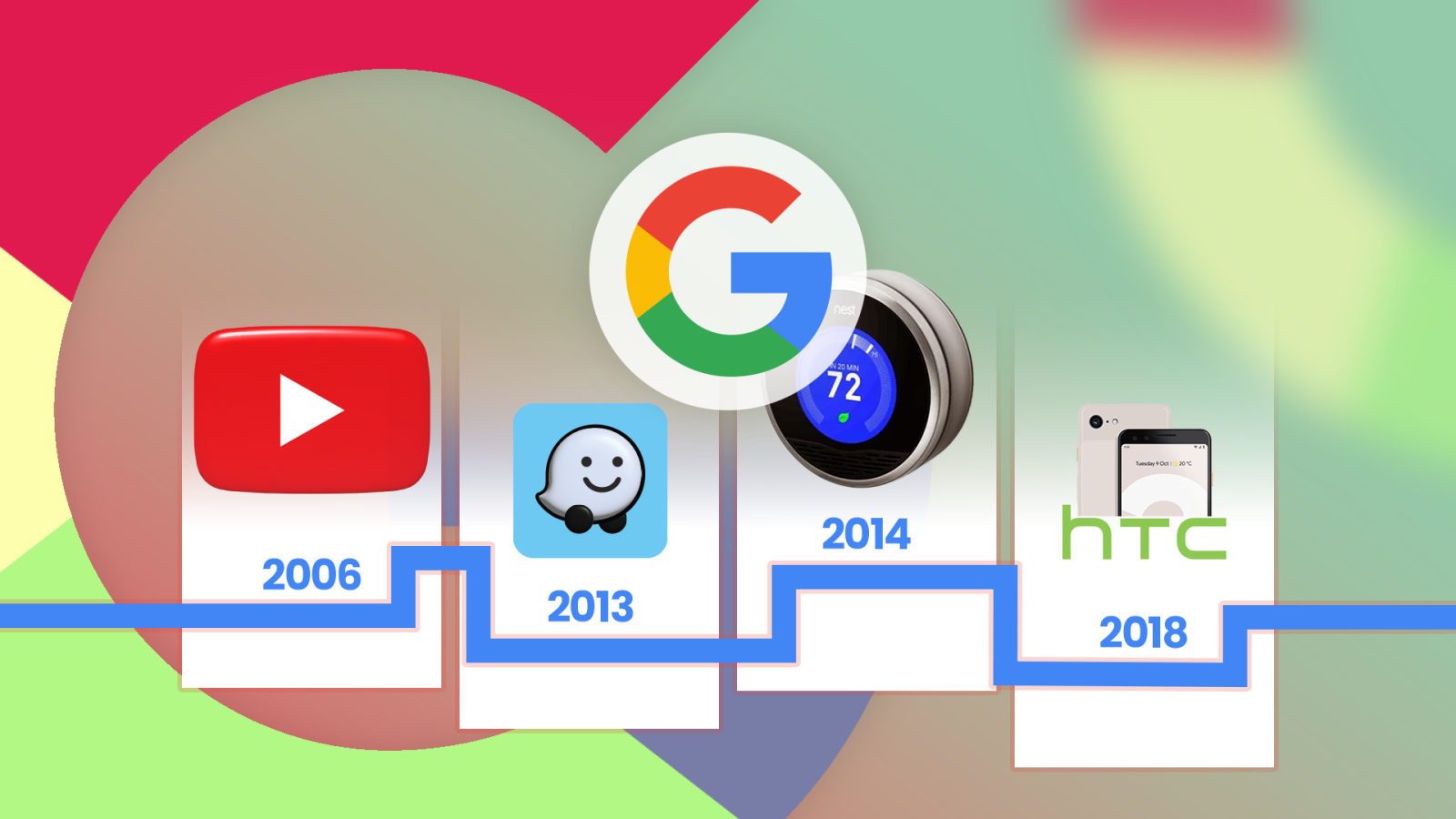

Scooping up promising startups and established services played a huge role in making Google a leader in cutting-edge tech. Google’s external acquisitions have been responsible for today’s useful smart devices, business tools, and user-friendly mapping apps.

Its recent $32.5 billion purchase of the Wiz, Inc. cloud security platform represents its biggest buyout by dollar amount. Although previous acquisitions may not have cost as much, the company’s savvy investment has done more than make a profit. It’s guided the entire tech landscape in apparent and less-than-obvious ways. These seven historic takeovers explain how the Big G got to where it is today.

Related

7 2006: The empire starts with YouTube

And online video streaming was never the same again

Then categorized as the “internet search leader,” Google absorbed the up-and-coming platform by exchanging $1.65 billion in stock. YouTube’s current value of between $200 billion and $400 billion makes that an impressive investment. It produced ad and subscription revenue of $50 billion in fiscal year 2024, and shows no sign of slowing down. There aren’t any significant competitors.

A 2006 perspective: Although some cynics have questioned YouTube’s staying power, Google is betting that the popular video-sharing site will provide it with an increasingly lucrative marketing hub as more viewers and advertisers migrate from television to the Internet. — NBC News

The 2006 takeover made short work of the video platform’s technical difficulties and slowing growth. Google took under its wing the relatively straightforward concept of letting people share homemade videos for free, monetized it, combined it with the information giant’s search capabilities, and now commands one of the most influential multimedia platforms in the world.

Related

4 reasons I continue to cough up $14 a month for YouTube Premium

YouTube Premium features, albeit expensive, save my mental health

The impact of Google buying YouTube stretches beyond revenue generation. YouTube’s enabling of corporate communications in countless industries, live-streaming of major current events and natural disasters, easily accessible educational content, and hard-to-fight misinformation have changed lives. After all, without YouTube, we wouldn’t know Justin Bieber.

6 2014: A bet on Nest and the smart home future

When a buyout throws a lifeline to an entire industry

Source: Anton Repponen (unsplash) / Android Police

Smart home technology took a while to go mainstream, but might never have taken off without Google’s help. Like YouTube, Nest Labs faced hardships before coming under Google’s control. Unlike Google’s YouTube investment, Nest’s $3.2 billion acquisition hasn’t turned out to be a golden goose, as a few years after the transaction, Google’s smart home business struggled to remain profitable.

The Nest buyout matters for more than return on investment. It inspired countless competitors and legitimized an industry many analysts value at over $100 billion. Competing brands offer a wider range of devices, but products like Google’s Nest Learning Thermostat and Nest Cam rank among the best due to straightforward setup and seamless Google integration.

Nest also brought more talent and data-harvesting streams into the Google Fold. Tony Fadell, the “father of the iPod,” led the company for two more years, ultimately becoming a direct advisor to Google leaders Brin and Pichai. Encouraging adoption of Google’s smart platform creates more avenues for harvesting consumer habits and demographics, giving the multinational so much of its current power. If Google refines its smart home ecosystem, it could continue leading in the field for years.

5 2013: Buying Waze makes a great product better

And Google started competing with itself

Source: Google/Unsplash

It’s hard to argue against Google Maps being the best general-purpose map service. However, Google’s 2013 purchase of Israeli startup Waze for $1.3 billion made sense for multiple reasons. It ended a rumored bidding war and kept the popular app out of Google’s competitors’ hands. It also provides Google, other advertisers, and government organizations with a stream of analytics data on how and where people travel.

Compared to Google Maps’ relatively broad functionality, Waze focuses on driving. In particular, its real-time, crowdsourced data on obstacles like accidents and speed traps makes Waze a beloved service among drivers looking to save time and gas.

Its streamlined alerts make trips easier and safer. Google Assistant integration means adding your experience as a driver is one short voice command away. Accurate traffic jam estimates let travelers know when they’ll arrive. Even though the Maps and Waze teams have been combined since 2022, Google’s acquisition and refinement of the top-notch driving aide made history by illustrating that Google can do great things by taking an app with a focused purpose and doubling down on it.

4 2018: Google buys HTC’s design team

Paving the way for the Pixels we know today

The Google Pixel 3 and 3 XL.

The first three Pixels and their XL variants came from HTC. Like their modern counterparts, they got rave reviews for user-friendly photography, and gave Google an outlet for its idealized version of Android. When Google finalized a $1.1 billion deal to acquire the talent responsible, it marked a commitment to in-house development from top to bottom.

The Pixel 3a and 3a XL emerged first from those internal efforts. They were good phones by most accounts, but not perfect. Google’s team followed up with the Pixel 4 and 4 XL, and began to solidify the brand’s identity with increasingly well-implemented features.

You see the long-term results of Google’s in-house development daily on Android Police. The now-iconic brand serves as a canvas for Android innovation, and gets the most cutting-edge features first. Some find Pixels polarizing, but they’ve influenced other manufacturers. For example, the trend toward long-term Android support started with Google’s seven-year promise. Pixel phones make up a small part of Google’s business, but they have a big impact on the industry.

3 2019: Looker cements Google’s place in the analytics race

Enabling business intelligence across cloud platforms

Source: Google

The Looker Studio all-in-one search console.

Google Cloud Services maintains 12% of the internet’s backbone, behind Amazon Web Services at 30% and Microsoft Intelligent Cloud with 21%. Always looking to increase its influence, Google bought analytics startup Looker for $2.6 billion in cash in 2019. The platform provides extensive modeling and self-service tools to help businesses stay on top of their game.

It’s another investment without an easily charted return, especially after Google integrated the data-management service within many popular products. Possibly the most influential application arose recently, with AWS customers now able to utilize its extensive insights since December 2024.

Modern businesses rely on data analysis to compete, and absorbing Looker helped put Google in charge of it. The toolkit affects every internet user by crafting specialized pathways for ambitious companies to succeed. It also lets Google rely less on its traditional online advertising model, which fluctuates in effectiveness and might not remain a revenue powerhouse forever.

2 2012: Motorola Mobility has patents, Google buys them

The move protected other Android developers, too

The 2013 Moto X, a precursor to today’s Pixels.

Google paid $12.5 billion for Motorola Mobility, LLC, a Motorola spinoff, in 2012. Twenty-one months later, Google sold most of it to Lenovo for under $3 billion. In the process, it retained the company’s trove of patents and the innovation-forward Advanced Technology and Projects group, for more than one reason.

Remember Project Ara? The ill-fated modular smartphone initiative was one example of Google ATAP’s work. It failed, as did Google’s attempt to reinvigorate Motorola smartphones. By the time Lenovo took over in 2014, the Big G had little to show for the deal. However, it still had the patents. They gave Android and third-party manufacturers a measure of defense against aggressive licensing fees from countless intellectual property owners.

Many experts considered Google’s Motorola Mobility moonshot a mistake, but one the company could withstand without major injury. It remains historic because it signaled Google’s intention to capture vertical markets (that is, control products’ entire design and ecosystem from top to bottom) and laid the groundwork for today’s thriving landscape of mobile devices, Pixel phones included.

1 2008: Aiming for data dominance with DoubleClick

The deal that shaped today’s internet, for better or worse

Source: Pradeep Singh / Google

The Google Marketing Platform, shortly after Google merged DoubleClick with it.

As Google rose in industry prominence and smartphones began to materialize, it established itself early on as a leading gatekeeper of marketing data with a $3.1 billion cash takeover of advertising giant DoubleClick. It’s impossible to overstate the deal’s effects.

At the time, Google lagged behind search competitors and fellow DoubleClick bidders Microsoft and Yahoo in advertising relationships. Buying DoubleClick changed that, and as importantly, prevented the other two from adding the service’s major marketing footprint. Suppressing the competition and inserting Google into the analytics leaderboard led to how we experience the World Wide Web today.

Related

It’s hard to imagine what the web would be like had Google never bought DoubleClick. In that light, it’s easily Google’s most meaningful acquisition, even if many consumers have never heard of it. Concentrating all that user data under one umbrella raised questions then, and continues to pose issues. Years after abandoning the DoubleClick name, its overarching goals still exist within Google’s apparent mission of hoarding, analyzing, and utilizing more data about people than any other company.

Acquiring companies, building portfolios, and making regulatory enemies

Governments worldwide continue to investigate potential monopoly law violations, with the US Department of Justice going so far as to threaten the forced sell-off of the Chrome browser to limit Google’s industry influence. In retrospect, one thing remains clear. Few companies had the capital, timing, and boldness to swing for the fences in a similar way. That’s why Google maintains a grip on software and data.

The recent Wiz acquisition works towards the same goal. In a push to claw cloud services market share away from Microsoft and Amazon, Google is betting big that its latest buyout follows the famous path of YouTube, instead of the underwhelming fate of Motorola Mobility. Only time will tell if Google’s right, but don’t bet against it.

What’s your reaction?

Love0

Sad0

Happy0

Sleepy0

Angry0

Dead0

Wink0

Leave a Reply

View Comments